Page 37 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 37

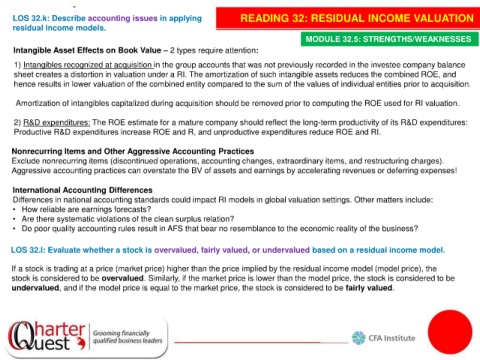

LOS 32.k: Describe accounting issues in applying READING 32: RESIDUAL INCOME VALUATION

residual income models.

MODULE 32.5: STRENGTHS/WEAKNESSES

Intangible Asset Effects on Book Value – 2 types require attention:

1) Intangibles recognized at acquisition in the group accounts that was not previously recorded in the investee company balance

sheet creates a distortion in valuation under a RI. The amortization of such intangible assets reduces the combined ROE, and

hence results in lower valuation of the combined entity compared to the sum of the values of individual entities prior to acquisition.

Amortization of intangibles capitalized during acquisition should be removed prior to computing the ROE used for RI valuation.

2) R&D expenditures: The ROE estimate for a mature company should reflect the long-term productivity of its R&D expenditures:

Productive R&D expenditures increase ROE and R, and unproductive expenditures reduce ROE and RI.

Nonrecurring Items and Other Aggressive Accounting Practices

Exclude nonrecurring items (discontinued operations, accounting changes, extraordinary items, and restructuring charges).

Aggressive accounting practices can overstate the BV of assets and earnings by accelerating revenues or deferring expenses!

International Accounting Differences

Differences in national accounting standards could impact RI models in global valuation settings. Other matters include:

• How reliable are earnings forecasts?

• Are there systematic violations of the clean surplus relation?

• Do poor quality accounting rules result in AFS that bear no resemblance to the economic reality of the business?

LOS 32.l: Evaluate whether a stock is overvalued, fairly valued, or undervalued based on a residual income model.

If a stock is trading at a price (market price) higher than the price implied by the residual income model (model price), the

stock is considered to be overvalued. Similarly, if the market price is lower than the model price, the stock is considered to be

undervalued, and if the model price is equal to the market price, the stock is considered to be fairly valued.