Page 40 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 40

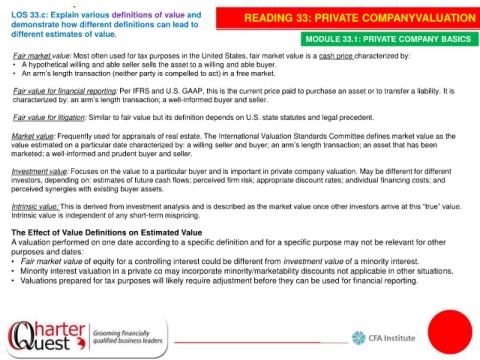

LOS 33.c: Explain various definitions of value and READING 33: PRIVATE COMPANYVALUATION

demonstrate how different definitions can lead to

different estimates of value.

MODULE 33.1: PRIVATE COMPANY BASICS

Fair market value: Most often used for tax purposes in the United States, fair market value is a cash price characterized by:

• A hypothetical willing and able seller sells the asset to a willing and able buyer.

• An arm’s length transaction (neither party is compelled to act) in a free market.

Fair value for financial reporting: Per IFRS and U.S. GAAP, this is the current price paid to purchase an asset or to transfer a liability. It is

characterized by: an arm’s length transaction; a well-informed buyer and seller.

Fair value for litigation: Similar to fair value but its definition depends on U.S. state statutes and legal precedent.

Market value: Frequently used for appraisals of real estate. The International Valuation Standards Committee defines market value as the

value estimated on a particular date characterized by: a willing seller and buyer; an arm’s length transaction; an asset that has been

marketed; a well-informed and prudent buyer and seller.

Investment value: Focuses on the value to a particular buyer and is important in private company valuation. May be different for different

investors, depending on: estimates of future cash flows; perceived firm risk; appropriate discount rates; andividual financing costs; and

perceived synergies with existing buyer assets.

Intrinsic value: This is derived from investment analysis and is described as the market value once other investors arrive at this “true” value.

Intrinsic value is independent of any short-term mispricing.

The Effect of Value Definitions on Estimated Value

A valuation performed on one date according to a specific definition and for a specific purpose may not be relevant for other

purposes and dates:

• Fair market value of equity for a controlling interest could be different from investment value of a minority interest.

• Minority interest valuation in a private co may incorporate minority/marketability discounts not applicable in other situations.

• Valuations prepared for tax purposes will likely require adjustment before they can be used for financial reporting.