Page 43 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 43

LOS 33.e: Explain cash flow estimation issues READING 33: PRIVATE COMPANYVALUATION

related to private companies and adjustments

required to estimate normalized earnings.

MODULE 33.2: INCOME-BASED VALUATION

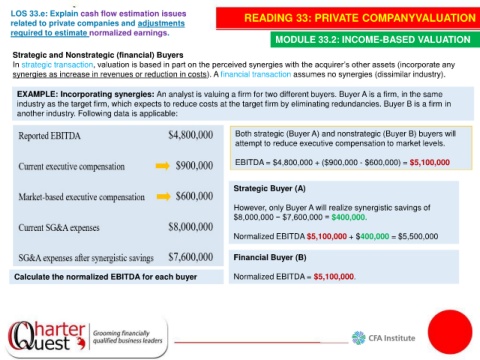

Strategic and Nonstrategic (financial) Buyers

In strategic transaction, valuation is based in part on the perceived synergies with the acquirer’s other assets (incorporate any

synergies as increase in revenues or reduction in costs). A financial transaction assumes no synergies (dissimilar industry).

EXAMPLE: Incorporating synergies: An analyst is valuing a firm for two different buyers. Buyer A is a firm, in the same

industry as the target firm, which expects to reduce costs at the target firm by eliminating redundancies. Buyer B is a firm in

another industry. Following data is applicable:

Both strategic (Buyer A) and nonstrategic (Buyer B) buyers will

attempt to reduce executive compensation to market levels.

EBITDA = $4,800,000 + ($900,000 - $600,000) = $5,100,000

Strategic Buyer (A)

However, only Buyer A will realize synergistic savings of

$8,000,000 − $7,600,000 = $400,000.

Normalized EBITDA $5,100,000 + $400,000 = $5,500,000

Financial Buyer (B)

Calculate the normalized EBITDA for each buyer Normalized EBITDA = $5,100,000.