Page 46 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 46

LOS 33.f: Calculate the value of a READING 33: PRIVATE COMPANYVALUATION

private company using free cash flow,

capitalized cash flow, and/or excess

earnings methods. MODULE 33.2: INCOME-BASED VALUATION

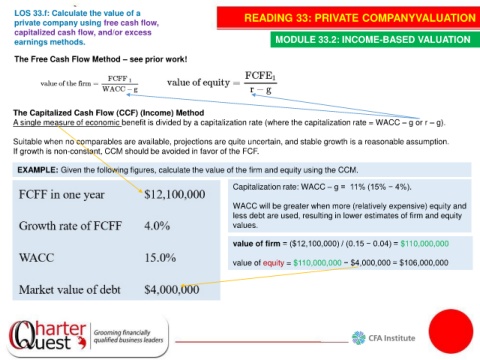

The Free Cash Flow Method – see prior work!

The Capitalized Cash Flow (CCF) (Income) Method

A single measure of economic benefit is divided by a capitalization rate (where the capitalization rate = WACC – g or r – g).

Suitable when no comparables are available, projections are quite uncertain, and stable growth is a reasonable assumption.

If growth is non-constant, CCM should be avoided in favor of the FCF.

EXAMPLE: Given the following figures, calculate the value of the firm and equity using the CCM.

Capitalization rate: WACC – g = 11% (15% − 4%).

WACC will be greater when more (relatively expensive) equity and

less debt are used, resulting in lower estimates of firm and equity

values.

value of firm = ($12,100,000) / (0.15 − 0.04) = $110,000,000

value of equity = $110,000,000 − $4,000,000 = $106,000,000