Page 49 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 49

LOS 33.h: Compare models used to estimate the

required rate of return to private company READING 33: PRIVATE COMPANYVALUATION

equity (for example, the CAPM, the expanded

CAPM, and the build-up approach). MODULE 33.2: INCOME-BASED VALUATION

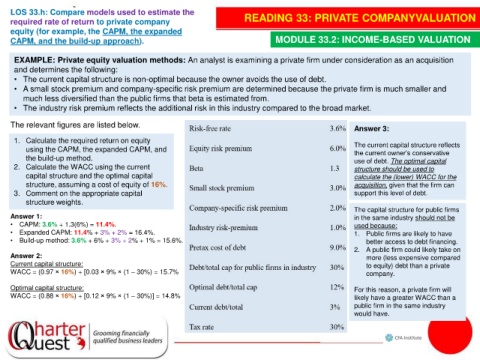

EXAMPLE: Private equity valuation methods: An analyst is examining a private firm under consideration as an acquisition

and determines the following:

• The current capital structure is non-optimal because the owner avoids the use of debt.

• A small stock premium and company-specific risk premium are determined because the private firm is much smaller and

much less diversified than the public firms that beta is estimated from.

• The industry risk premium reflects the additional risk in this industry compared to the broad market.

The relevant figures are listed below.

Answer 3:

1. Calculate the required return on equity The current capital structure reflects

using the CAPM, the expanded CAPM, and the current owner’s conservative

the build-up method. use of debt. The optimal capital

2. Calculate the WACC using the current structure should be used to

capital structure and the optimal capital calculate the (lower) WACC for the

structure, assuming a cost of equity of 16%. acquisition, given that the firm can

3. Comment on the appropriate capital support this level of debt.

structure weights.

The capital structure for public firms

Answer 1: in the same industry should not be

• CAPM: 3.6% + 1.3(6%) = 11.4%. used because:

• Expanded CAPM: 11.4% + 3% + 2% = 16.4%. 1. Public firms are likely to have

• Build-up method: 3.6% + 6% + 3% + 2% + 1% = 15.6%. better access to debt financing.

2. A public firm could likely take on

Answer 2: more (less expensive compared

Current capital structure: to equity) debt than a private

WACC = (0.97 × 16%) + [0.03 × 9% × (1 – 30%) = 15.7% company.

Optimal capital structure: For this reason, a private firm will

WACC = (0.88 × 16%) + [0.12 × 9% × (1 – 30%)] = 14.8% likely have a greater WACC than a

public firm in the same industry

would have.