Page 53 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 53

LOS 33.k: Explain and evaluate the effects on READING 33: PRIVATE COMPANYVALUATION

private company valuations of discounts and

premiums based on control and marketability.

MODULE 33.4: VALUATION DISCOUNTS

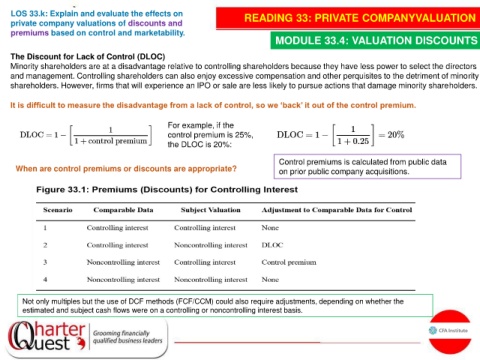

The Discount for Lack of Control (DLOC)

Minority shareholders are at a disadvantage relative to controlling shareholders because they have less power to select the directors

and management. Controlling shareholders can also enjoy excessive compensation and other perquisites to the detriment of minority

shareholders. However, firms that will experience an IPO or sale are less likely to pursue actions that damage minority shareholders.

It is difficult to measure the disadvantage from a lack of control, so we ‘back’ it out of the control premium.

For example, if the

control premium is 25%,

the DLOC is 20%:

Control premiums is calculated from public data

When are control premiums or discounts are appropriate? on prior public company acquisitions.

Not only multiples but the use of DCF methods (FCF/CCM) could also require adjustments, depending on whether the

estimated and subject cash flows were on a controlling or noncontrolling interest basis.