Page 55 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 55

LOS 33.k: Explain and evaluate the effects on READING 33: PRIVATE COMPANYVALUATION

private company valuations of discounts and

premiums based on control and marketability.

MODULE 33.4: VALUATION DISCOUNTS

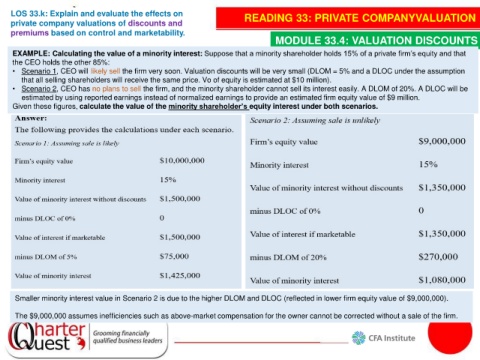

EXAMPLE: Calculating the value of a minority interest: Suppose that a minority shareholder holds 15% of a private firm’s equity and that

the CEO holds the other 85%:

• Scenario 1, CEO will likely sell the firm very soon. Valuation discounts will be very small (DLOM = 5% and a DLOC under the assumption

that all selling shareholders will receive the same price. Vo of equity is estimated at $10 million).

• Scenario 2, CEO has no plans to sell the firm, and the minority shareholder cannot sell its interest easily. A DLOM of 20%. A DLOC will be

estimated by using reported earnings instead of normalized earnings to provide an estimated firm equity value of $9 million.

Given these figures, calculate the value of the minority shareholder’s equity interest under both scenarios.

Smaller minority interest value in Scenario 2 is due to the higher DLOM and DLOC (reflected in lower firm equity value of $9,000,000).

The $9,000,000 assumes inefficiencies such as above-market compensation for the owner cannot be corrected without a sale of the firm.