Page 54 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 54

LOS 33.k: Explain and evaluate the effects on READING 33: PRIVATE COMPANYVALUATION

private company valuations of discounts and

premiums based on control and marketability.

MODULE 33.4: VALUATION DISCOUNTS

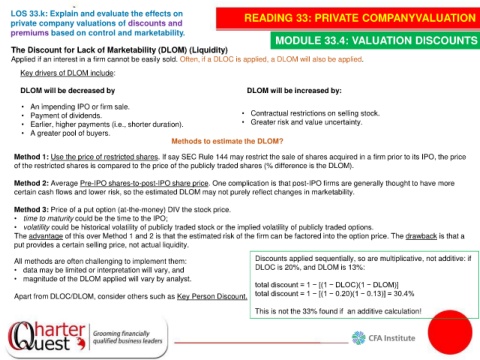

The Discount for Lack of Marketability (DLOM) (Liquidity)

Applied if an interest in a firm cannot be easily sold. Often, if a DLOC is applied, a DLOM will also be applied.

Key drivers of DLOM include:

DLOM will be decreased by DLOM will be increased by:

• An impending IPO or firm sale.

• Payment of dividends. • Contractual restrictions on selling stock.

• Earlier, higher payments (i.e., shorter duration). • Greater risk and value uncertainty.

• A greater pool of buyers.

Methods to estimate the DLOM?

Method 1: Use the price of restricted shares. If say SEC Rule 144 may restrict the sale of shares acquired in a firm prior to its IPO, the price

of the restricted shares is compared to the price of the publicly traded shares (% difference is the DLOM).

Method 2: Average Pre-IPO shares-to-post-IPO share price. One complication is that post-IPO firms are generally thought to have more

certain cash flows and lower risk, so the estimated DLOM may not purely reflect changes in marketability.

Method 3: Price of a put option (at-the-money) DIV the stock price.

• time to maturity could be the time to the IPO;

• volatility could be historical volatility of publicly traded stock or the implied volatility of publicly traded options.

The advantage of this over Method 1 and 2 is that the estimated risk of the firm can be factored into the option price. The drawback is that a

put provides a certain selling price, not actual liquidity.

All methods are often challenging to implement them: Discounts applied sequentially, so are multiplicative, not additive: if

• data may be limited or interpretation will vary, and DLOC is 20%, and DLOM is 13%:

• magnitude of the DLOM applied will vary by analyst.

total discount = 1 − [(1 − DLOC)(1 − DLOM)]

Apart from DLOC/DLOM, consider others such as Key Person Discount. total discount = 1 − [(1 − 0.20)(1 − 0.13)] = 30.4%

This is not the 33% found if an additive calculation!