Page 50 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 50

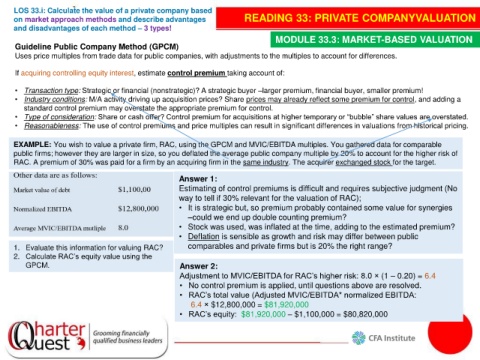

LOS 33.i: Calculate the value of a private company based

on market approach methods and describe advantages READING 33: PRIVATE COMPANYVALUATION

and disadvantages of each method – 3 types!

MODULE 33.3: MARKET-BASED VALUATION

Guideline Public Company Method (GPCM)

Uses price multiples from trade data for public companies, with adjustments to the multiples to account for differences.

If acquiring controlling equity interest, estimate control premium taking account of:

• Transaction type: Strategic or financial (nonstrategic)? A strategic buyer –larger premium, financial buyer, smaller premium!

• Industry conditions: M/A activity driving up acquisition prices? Share prices may already reflect some premium for control, and adding a

standard control premium may overstate the appropriate premium for control.

• Type of consideration: Share or cash offer? Control premium for acquisitions at higher temporary or “bubble” share values are overstated.

• Reasonableness: The use of control premiums and price multiples can result in significant differences in valuations from historical pricing.

EXAMPLE: You wish to value a private firm, RAC, using the GPCM and MVIC/EBITDA multiples. You gathered data for comparable

public firms; however they are larger in size, so you deflated the average public company multiple by 20% to account for the higher risk of

RAC. A premium of 30% was paid for a firm by an acquiring firm in the same industry. The acquirer exchanged stock for the target.

Answer 1:

Estimating of control premiums is difficult and requires subjective judgment (No

way to tell if 30% relevant for the valuation of RAC);

• It is strategic but, so premium probably contained some value for synergies

–could we end up double counting premium?

• Stock was used, was inflated at the time, adding to the estimated premium?

• Deflation is sensible as growth and risk may differ between public

1. Evaluate this information for valuing RAC? comparables and private firms but is 20% the right range?

2. Calculate RAC’s equity value using the

GPCM. Answer 2:

Adjustment to MVIC/EBITDA for RAC’s higher risk: 8.0 × (1 – 0.20) = 6.4

• No control premium is applied, until questions above are resolved.

• RAC’s total value (Adjusted MVIC/EBITDA* normalized EBITDA:

6.4 × $12,800,000 = $81,920,000

• RAC’s equity: $81,920,000 – $1,100,000 = $80,820,000