Page 51 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 51

LOS 33.i: Calculate the value of a private company

based on market approach methods and describe READING 33: PRIVATE COMPANYVALUATION

advantages and disadvantages of each method – 3

types! MODULE 33.3: MARKET-BASED VALUATION

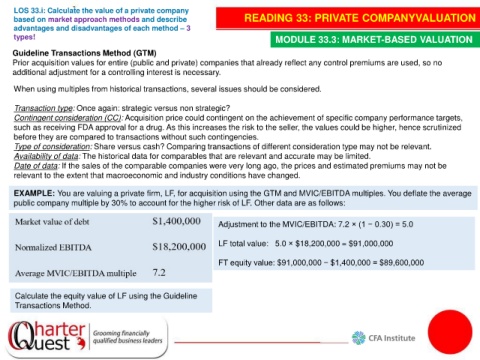

Guideline Transactions Method (GTM)

Prior acquisition values for entire (public and private) companies that already reflect any control premiums are used, so no

additional adjustment for a controlling interest is necessary.

When using multiples from historical transactions, several issues should be considered.

Transaction type: Once again: strategic versus non strategic?

Contingent consideration (CC): Acquisition price could contingent on the achievement of specific company performance targets,

such as receiving FDA approval for a drug. As this increases the risk to the seller, the values could be higher, hence scrutinized

before they are compared to transactions without such contingencies.

Type of consideration: Share versus cash? Comparing transactions of different consideration type may not be relevant.

Availability of data: The historical data for comparables that are relevant and accurate may be limited.

Date of data: If the sales of the comparable companies were very long ago, the prices and estimated premiums may not be

relevant to the extent that macroeconomic and industry conditions have changed.

EXAMPLE: You are valuing a private firm, LF, for acquisition using the GTM and MVIC/EBITDA multiples. You deflate the average

public company multiple by 30% to account for the higher risk of LF. Other data are as follows:

Adjustment to the MVIC/EBITDA: 7.2 × (1 − 0.30) = 5.0

LF total value: 5.0 × $18,200,000 = $91,000,000

FT equity value: $91,000,000 − $1,400,000 = $89,600,000

Calculate the equity value of LF using the Guideline

Transactions Method.