Page 193 - SBL Integrated Workbook STUDENT 2018

P. 193

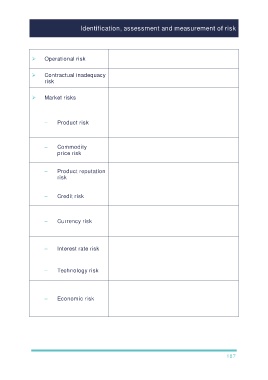

Identification, assessment and measurement of risk

Risk that business operations may be inefficient or

Operational risk

business changes may fail.

Contractual inadequacy Risk that the terms of a contract do not fully cover a

risk business against all potential outcomes.

Risks which derive from the sector in which the

Market risks

business is operating, and from its customers.

The risk that customers will not buy new products

(or services) provided by the organisation or that the

– Product risk

sales demand for current products and services will

decline unexpectedly.

Businesses might be exposed to risks from

– Commodity unexpected increases (or falls) in the price of a key

price risk

commodity.

Some companies rely heavily on brand image and

– Product reputation product reputation, and an adverse event could put

risk

its reputation (and so future sales) at risk.

Credit risk is the possibility of losses due to non-

– Credit risk

payment, or late payment, by customers.

Currency risk, or foreign exchange risk, arises from

the possibility of movements in foreign exchange

– Currency risk

rates, and the value of one currency in relation to

another.

Interest rate risk is the risk of unexpected gains or

– Interest rate risk losses arising as a consequence of a rise or fall in

interest rates.

This arises from the possibility that technological

– Technology risk

change will occur.

This refers to the risks facing organisations from

changes in economic conditions, such as economic

– Economic risk growth or recession, government spending policy

and taxation policy, unemployment levels and

international trading conditions.

187