Page 284 - P1 Integrated Workbook STUDENT 2018

P. 284

Subject P1: Management Accounting

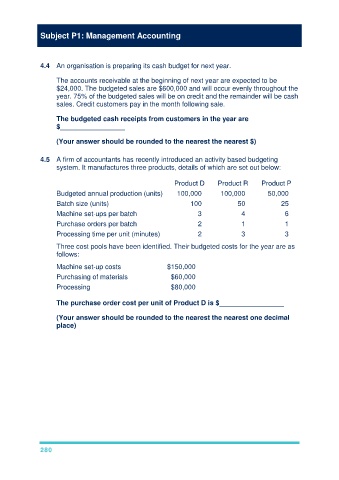

4.4 An organisation is preparing its cash budget for next year.

The accounts receivable at the beginning of next year are expected to be

$24,000. The budgeted sales are $600,000 and will occur evenly throughout the

year. 75% of the budgeted sales will be on credit and the remainder will be cash

sales. Credit customers pay in the month following sale.

The budgeted cash receipts from customers in the year are

$_________________

(Your answer should be rounded to the nearest the nearest $)

4.5 A firm of accountants has recently introduced an activity based budgeting

system. It manufactures three products, details of which are set out below:

Product D Product R Product P

Budgeted annual production (units) 100,000 100,000 50,000

Batch size (units) 100 50 25

Machine set-ups per batch 3 4 6

Purchase orders per batch 2 1 1

Processing time per unit (minutes) 2 3 3

Three cost pools have been identified. Their budgeted costs for the year are as

follows:

Machine set-up costs $150,000

Purchasing of materials $60,000

Processing $80,000

The purchase order cost per unit of Product D is $_________________

(Your answer should be rounded to the nearest the nearest one decimal

place)

280