Page 13 - Test 2 Cycle Slides - General Deductions Class SlidesCapital Allowances Recoupments

P. 13

The following law amendments were

DEDUCTIONS

promulgated in the Taxation Laws

Amendment Act No. 23 of 2018 (on 17

January 2019).

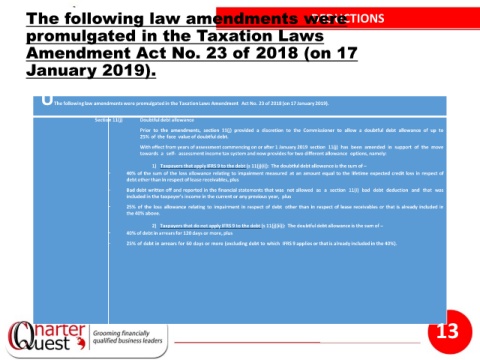

UThe followinglaw amendments were promulgatedin the TaxationLaws Amendment Act No. 23 of 2018(on 17 January2019).

Section 11(j) Doubtful debt allowance

Prior to the amendments, section 11(j) provided a discretion to the Commissioner to allow a doubtful debt allowance of up to

25% of the face value of doubtful debt.

With effect from years of assessment commencing on or after 1 January 2019 section 11(j) has been amended in support of the move

towards a self- assessment income tax system and now provides for two different allowance options, namely:

1) Taxpayers that apply IFRS 9 to the debt (s 11(j)(i)): The doubtful debt allowance is the sum of –

- 40% of the sum of the loss allowance relating to impairment measured at an amount equal to the lifetime expected credit loss in respect of

debt other than in respect of lease receivables, plus

- Bad debt written off and reported in the financial statements that was not allowed as a section 11(i) bad debt deduction and that was

included in the taxpayer’s income in the current or any previous year, plus

- 25% of the loss allowance relating to impairment in respect of debt other than in respect of lease receivables or that is already included in

the 40% above.

2) Taxpayers that do not apply IFRS 9 to the debt (s 11(j)(ii)): The doubtful debt allowance is the sum of –

- 40% of debt in arrears for 120 days or more, plus

- 25% of debt in arrears for 60 days or more (excluding debt to which IFRS 9 applies or that is already includedin the 40%).

13