Page 14 - Test 2 Cycle Slides - General Deductions Class SlidesCapital Allowances Recoupments

P. 14

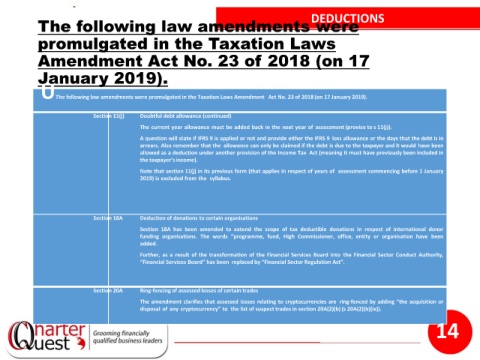

DEDUCTIONS

The following law amendments were

promulgated in the Taxation Laws

Amendment Act No. 23 of 2018 (on 17

January 2019).

UThe following law amendments were promulgated in the Taxation Laws Amendment Act No. 23 of 2018 (on 17 January 2019).

Section 11(j) Doubtful debt allowance (continued)

The current year allowance must be added back in the next year of assessment (proviso to s 11(j)).

A question will state if IFRS 9 is applied or not and provide either the IFRS 9 loss allowance or the days that the debt is in

arrears. Also remember that the allowance can only be claimed if the debt is due to the taxpayer and it would have been

allowed as a deduction under another provision of the Income Tax Act (meaning it must have previously been included in

the taxpayer’s income).

Note that section 11(j) in its previous form (that applies in respect of years of assessment commencing before 1 January

2019) is excluded from the syllabus.

Section 18A Deduction of donations to certain organisations

Section 18A has been amended to extend the scope of tax deductible donations in respect of international donor

funding organisations. The words “programme, fund, High Commissioner, office, entity or organisation have been

added.

Further, as a result of the transformation of the Financial Services Board into the Financial Sector Conduct Authority,

“Financial Services Board” has been replaced by “Financial Sector Regulation Act”.

Section 20A Ring-fencing of assessed losses of certain trades

The amendment clarifies that assessed losses relating to cryptocurrencies are ring-fenced by adding “the acquisition or

disposal of any cryptocurrency” to the list of suspect trades in section 20A(2)(b) (s 20A(2)(b)(ix)).

14