Page 6 - PowerPoint Presentation

P. 6

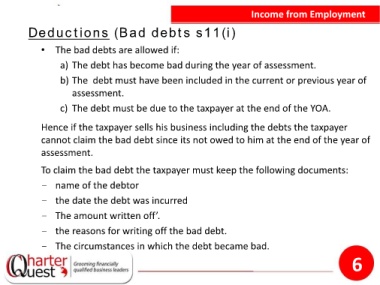

Income from Employment

Deductions (Bad debts s11(i)

• The bad debts are allowed if:

a) The debt has become bad during the year of assessment.

b) The debt must have been included in the current or previous year of

assessment.

c) The debt must be due to the taxpayer at the end of the YOA.

Hence if the taxpayer sells his business including the debts the taxpayer

cannot claim the bad debt since its not owed to him at the end of the year of

assessment.

To claim the bad debt the taxpayer must keep the following documents:

- name of the debtor

- the date the debt was incurred

- The amount written off’.

- the reasons for writing off the bad debt.

- The circumstances in which the debt became bad.

6