Page 9 - PowerPoint Presentation

P. 9

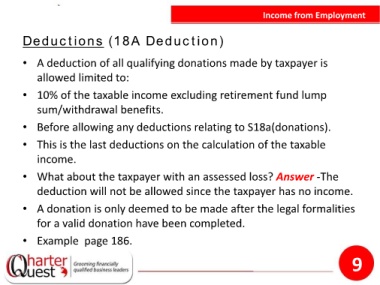

Income from Employment

Deductions (18A Deduction)

• A deduction of all qualifying donations made by taxpayer is

allowed limited to:

• 10% of the taxable income excluding retirement fund lump

sum/withdrawal benefits.

• Before allowing any deductions relating to S18a(donations).

• This is the last deductions on the calculation of the taxable

income.

• What about the taxpayer with an assessed loss? Answer -The

deduction will not be allowed since the taxpayer has no income.

• A donation is only deemed to be made after the legal formalities

for a valid donation have been completed.

• Example page 186.

9