Page 276 - Microsoft Word - 00 Prelims.docx

P. 276

Chapter 12

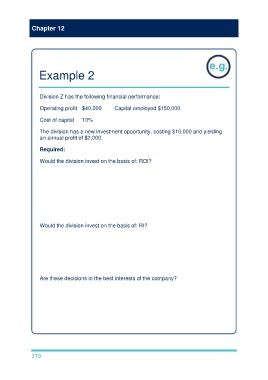

Example 2

Division Z has the following financial performance:

Operating profit $40,000 Capital employed $150,000

Cost of capital 10%

The division has a new investment opportunity, costing $10,000 and yielding

an annual profit of $2,000.

Required:

Would the division invest on the basis of: ROI?

Current ROI = ($40k ÷ $150k) × 100 26.7%

ROI with new investment = ($42k ÷ $160k) × 100 26.3%

ROI of new investment = ($2k ÷ $10k) × 100 20.0%

Decision: The division would not accept the investment, as it would reduce

the division’s ROI.

Would the division invest on the basis of: RI?

Current RI = $40k – (10% × $150k) $25K

RI with new investment = $42k – (10% × $160k) $26k

Decision: The division would accept the investment since it generates an

increase in RI of $1,000.

Are these decisions in the best interests of the company?

The decision not to invest based on ROI is not in the best interests of the

company since the ROI (20%) is greater than the company’s cost of capital

(10%), i.e. dysfunctional behaviour.

The decision to invest based on RI is in the best interests of the company

since the project’s return of 20% is greater than the company’s cost of capital

of 10% (no dysfunctional behaviour).

270