Page 38 - FINAL CFA I SLIDES JUNE 2019 DAY 10

P. 38

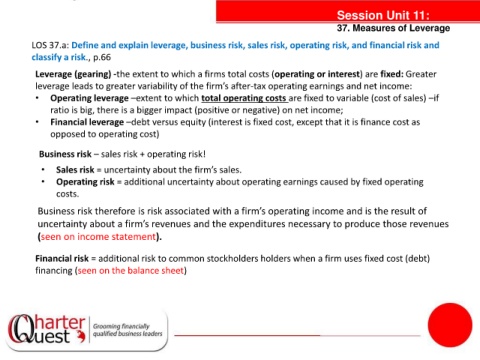

Session Unit 11:

37. Measures of Leverage

LOS 37.a: Define and explain leverage, business risk, sales risk, operating risk, and financial risk and

classify a risk., p.66

Leverage (gearing) -the extent to which a firms total costs (operating or interest) are fixed: Greater

leverage leads to greater variability of the firm’s after-tax operating earnings and net income:

• Operating leverage –extent to which total operating costs are fixed to variable (cost of sales) –if

ratio is big, there is a bigger impact (positive or negative) on net income;

• Financial leverage –debt versus equity (interest is fixed cost, except that it is finance cost as

opposed to operating cost)

tanties

Business risk – sales risk + operating risk!

• Sales risk = uncertainty about the firm’s sales.

• Operating risk = additional uncertainty about operating earnings caused by fixed operating

costs.

Business risk therefore is risk associated with a firm’s operating income and is the result of

uncertainty about a firm’s revenues and the expenditures necessary to produce those revenues

(seen on income statement).

Financial risk = additional risk to common stockholders holders when a firm uses fixed cost (debt)

financing (seen on the balance sheet)