Page 41 - MAC4861_2 Costing Class Slides Part 1

P. 41

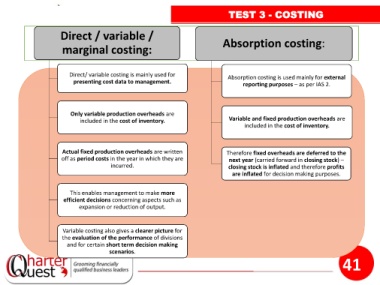

TEST 3 - COSTING

Direct / variable /

Absorption vs Variable costing

Absorption costing:

marginal costing:

Direct/ variable costing is mainly used for Absorption costing is used mainly for external

presenting cost data to management.

reporting purposes – as per IAS 2.

Only variable production overheads are

included in the cost of inventory. Variable and fixed production overheads are

included in the cost of inventory.

Actual fixed production overheads are written Therefore fixed overheads are deferred to the

off as period costs in the year in which they are next year (carried forward in closing stock) –

incurred. closing stock is inflated and therefore profits

are inflated for decision making purposes.

This enables management to make more

efficient decisions concerning aspects such as

expansion or reduction of output.

Variable costing also gives a clearer picture for

the evaluation of the performance of divisions

and for certain short term decision making

scenarios.

41