Page 14 - PowerPoint Presentation

P. 14

GOVERNMENT GRANTS AND GOVERNMENT ASSISTANCE

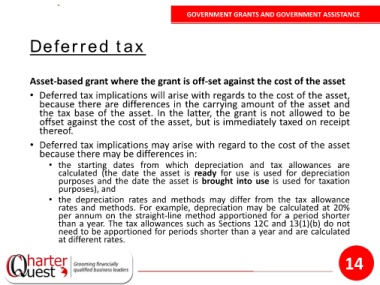

Deferred tax

Asset-based grant where the grant is off-set against the cost of the asset

• Deferred tax implications will arise with regards to the cost of the asset,

because there are differences in the carrying amount of the asset and

the tax base of the asset. In the latter, the grant is not allowed to be

offset against the cost of the asset, but is immediately taxed on receipt

thereof.

• Deferred tax implications may arise with regard to the cost of the asset

because there may be differences in:

• the starting dates from which depreciation and tax allowances are

calculated (the date the asset is ready for use is used for depreciation

purposes and the date the asset is brought into use is used for taxation

purposes), and

• the depreciation rates and methods may differ from the tax allowance

rates and methods. For example, depreciation may be calculated at 20%

per annum on the straight-line method apportioned for a period shorter

than a year. The tax allowances such as Sections 12C and 13(1)(b) do not

need to be apportioned for periods shorter than a year and are calculated

at different rates.

14