Page 432 - F1 Integrated Workbook STUDENT 2018

P. 432

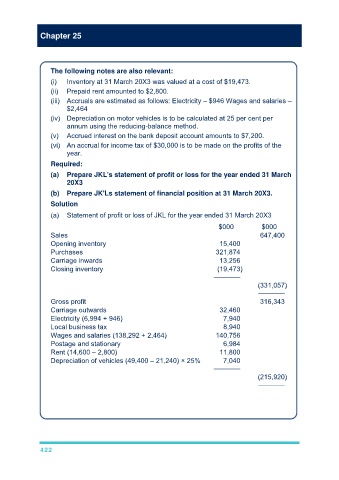

Chapter 25

The following notes are also relevant:

(i) Inventory at 31 March 20X3 was valued at a cost of $19,473.

(ii) Prepaid rent amounted to $2,800.

(iii) Accruals are estimated as follows: Electricity – $946 Wages and salaries –

$2,464

(iv) Depreciation on motor vehicles is to be calculated at 25 per cent per

annum using the reducing-balance method.

(v) Accrued interest on the bank deposit account amounts to $7,200.

(vi) An accrual for income tax of $30,000 is to be made on the profits of the

year.

Required:

(a) Prepare JKL's statement of profit or loss for the year ended 31 March

20X3

(b) Prepare JK'Ls statement of financial position at 31 March 20X3.

Solution

(a) Statement of profit or loss of JKL for the year ended 31 March 20X3

$000 $000

Sales 647,400

Opening inventory 15,400

Purchases 321,874

Carriage inwards 13,256

Closing inventory (19,473)

–––––––

(331,057)

–––––––

Gross profit 316,343

Carriage outwards 32,460

Electricity (6,994 + 946) 7,940

Local business tax 8,940

Wages and salaries (138,292 + 2,464) 140,756

Postage and stationary 6,984

Rent (14,600 – 2,800) 11,800

Depreciation of vehicles (49,400 – 21,240) × 25% 7,040

–––––––

(215,920)

–––––––

422