Page 433 - F1 Integrated Workbook STUDENT 2018

P. 433

Answers

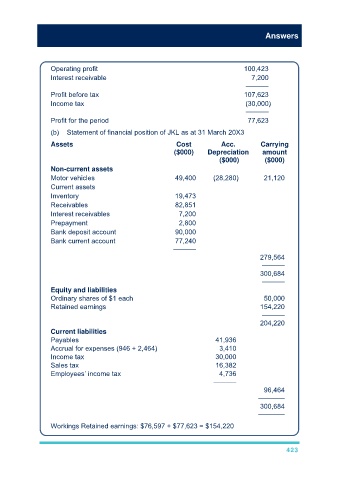

Operating profit 100,423

Interest receivable 7,200

––––––

Profit before tax 107,623

Income tax (30,000)

––––––

Profit for the period 77,623

(b) Statement of financial position of JKL as at 31 March 20X3

Assets Cost Acc. Carrying

($000) Depreciation amount

($000) ($000)

Non-current assets

Motor vehicles 49,400 (28,280) 21,120

Current assets

Inventory 19,473

Receivables 82,851

Interest receivables 7,200

Prepayment 2,800

Bank deposit account 90,000

Bank current account 77,240

––––––

279,564

––––––

300,684

––––––

Equity and liabilities

Ordinary shares of $1 each 50,000

Retained earnings 154,220

––––––

204,220

Current liabilities

Payables 41,936

Accrual for expenses (946 + 2,464) 3,410

Income tax 30,000

Sales tax 16,382

Employees’ income tax 4,736

––––––

96,464

–––––––

300,684

–––––––

Workings Retained earnings: $76,597 + $77,623 = $154,220

423