Page 46 - F1 Integrated Workbook STUDENT 2018

P. 46

Chapter 2

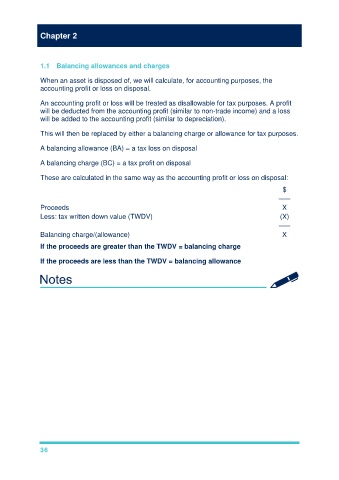

1.1 Balancing allowances and charges

When an asset is disposed of, we will calculate, for accounting purposes, the

accounting profit or loss on disposal.

An accounting profit or loss will be treated as disallowable for tax purposes. A profit

will be deducted from the accounting profit (similar to non-trade income) and a loss

will be added to the accounting profit (similar to depreciation).

This will then be replaced by either a balancing charge or allowance for tax purposes.

A balancing allowance (BA) = a tax loss on disposal

A balancing charge (BC) = a tax profit on disposal

These are calculated in the same way as the accounting profit or loss on disposal:

$

–––

Proceeds X

Less: tax written down value (TWDV) (X)

–––

Balancing charge/(allowance) X

If the proceeds are greater than the TWDV = balancing charge

If the proceeds are less than the TWDV = balancing allowance

36