Page 47 - F1 Integrated Workbook STUDENT 2018

P. 47

Corporate Income Tax and Capital Tax Computations

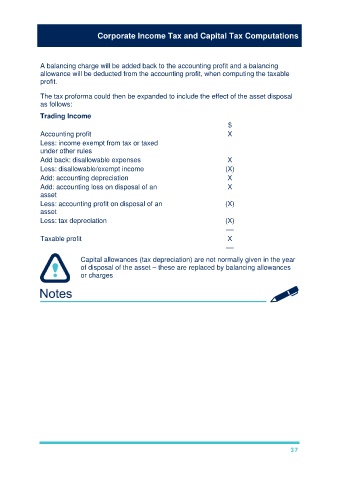

A balancing charge will be added back to the accounting profit and a balancing

allowance will be deducted from the accounting profit, when computing the taxable

profit.

The tax proforma could then be expanded to include the effect of the asset disposal

as follows:

Trading Income

$

Accounting profit X

Less: income exempt from tax or taxed

under other rules

Add back: disallowable expenses X

Less: disallowable/exempt income (X)

Add: accounting depreciation X

Add: accounting loss on disposal of an X

asset

Less: accounting profit on disposal of an (X)

asset

Less: tax depreciation (X)

––

Taxable profit X

––

Capital allowances (tax depreciation) are not normally given in the year

of disposal of the asset – these are replaced by balancing allowances

or charges

37