Page 13 - PowerPoint Presentation

P. 13

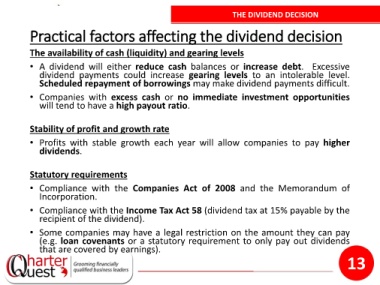

THE DIVIDEND DECISION

Practical factors affecting the dividend decision

The availability of cash (liquidity) and gearing levels

• A dividend will either reduce cash balances or increase debt. Excessive

dividend payments could increase gearing levels to an intolerable level.

Scheduled repayment of borrowings may make dividend payments difficult.

• Companies with excess cash or no immediate investment opportunities

will tend to have a high payout ratio.

Stability of profit and growth rate

• Profits with stable growth each year will allow companies to pay higher

dividends.

Statutory requirements

• Compliance with the Companies Act of 2008 and the Memorandum of

Incorporation.

• Compliance with the Income Tax Act 58 (dividend tax at 15% payable by the

recipient of the dividend).

• Some companies may have a legal restriction on the amount they can pay

(e.g. loan covenants or a statutory requirement to only pay out dividends

that are covered by earnings).

13