Page 14 - PowerPoint Presentation

P. 14

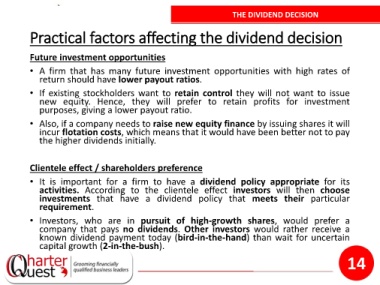

THE DIVIDEND DECISION

Practical factors affecting the dividend decision

Future investment opportunities

• A firm that has many future investment opportunities with high rates of

return should have lower payout ratios.

• If existing stockholders want to retain control they will not want to issue

new equity. Hence, they will prefer to retain profits for investment

purposes, giving a lower payout ratio.

• Also, if a company needs to raise new equity finance by issuing shares it will

incur flotation costs, which means that it would have been better not to pay

the higher dividends initially.

Clientele effect / shareholders preference

• It is important for a firm to have a dividend policy appropriate for its

activities. According to the clientele effect investors will then choose

investments that have a dividend policy that meets their particular

requirement.

• Investors, who are in pursuit of high-growth shares, would prefer a

company that pays no dividends. Other investors would rather receive a

known dividend payment today (bird-in-the-hand) than wait for uncertain

capital growth (2-in-the-bush).

14