Page 11 - FINAL CFA I SLIDES JUNE 2019 DAY 4

P. 11

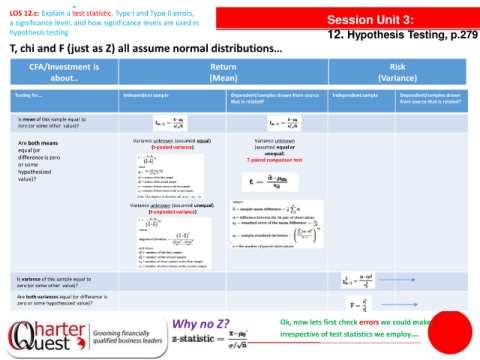

LOS 12.c: Explain a test statistic, Type I and Type II errors,

a significance level, and how significance levels are used in Session Unit 3:

hypothesis testing 12. Hypothesis Testing, p.279

T, chi and F (just as Z) all assume normal distributions…

CFA/Investment is Return Risk

about.. (Mean) (Variance)

Testing for… Independent sample Dependent/samples drawn from source Independent sample Dependent/samples drawn

that is related? from source that is related?

Is mean of this sample equal to

zero (or some other value)?

Are both means Variance unknown (assumed equal) Variance unknown

equal (or (t-pooled variance) (assumed equal or

unequal)

difference is zero T-paired comparison test

or some

hypothesized

value)?

Variance unknown (assumed unequal)

(t-unpooled variance)

Is variance of this sample equal to

zero (or some other value)?

Are both variances equal (or difference is

zero or some hypothesized value)? Will return to these shortly…

Why no Z? Ok, now lets first check errors we could make,

irrespective of test statistics we employ…