Page 18 - FINAL CFA I SLIDES JUNE 2019 DAY 4

P. 18

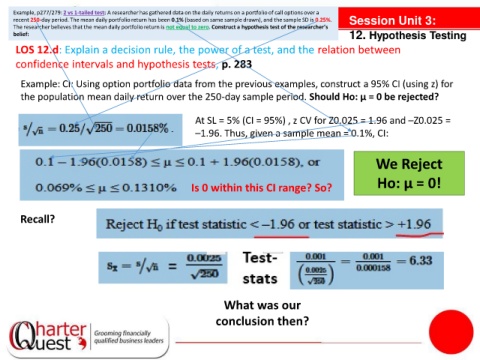

Example, p277/279: 2 vs 1-tailed test: A researcher has gathered data on the daily returns on a portfolio of call options over a

recent 250-day period. The mean daily portfolio return has been 0.1% (based on same sample drawn), and the sample SD is 0.25%. Session Unit 3:

The researcher believes that the mean daily portfolio return is not equal to zero. Construct a hypothesis test of the researcher’s

belief: 12. Hypothesis Testing

LOS 12.d: Explain a decision rule, the power of a test, and the relation between

confidence intervals and hypothesis tests, p. 283

Example: CI: Using option portfolio data from the previous examples, construct a 95% CI (using z) for

the population mean daily return over the 250-day sample period. Should Ho: µ = 0 be rejected?

At SL = 5% (CI = 95%) , z CV for Z0.025 = 1.96 and –Z0.025 =

–1.96. Thus, given a sample mean = 0.1%, CI:

We Reject

Ho: µ = 0!

Is 0 within this CI range? So?

Recall?

What was our

conclusion then?