Page 28 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 28

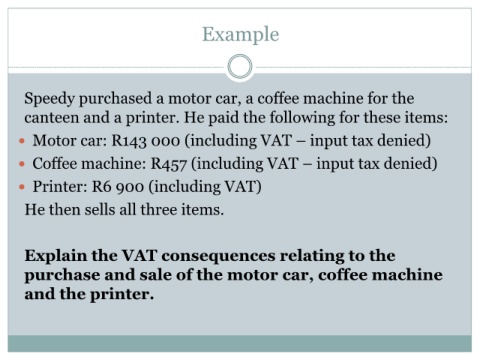

Example

Speedy purchased a motor car, a coffee machine for the

canteen and a printer. He paid the following for these items:

Motor car: R143 000 (including VAT – input tax denied)

Coffee machine: R457 (including VAT – input tax denied)

Printer: R6 900 (including VAT)

He then sells all three items.

Explain the VAT consequences relating to the

purchase and sale of the motor car, coffee machine

and the printer.