Page 29 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 29

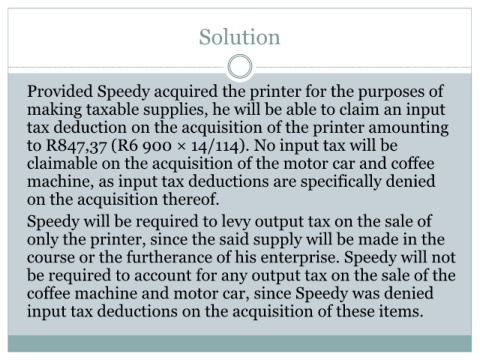

Solution

Provided Speedy acquired the printer for the purposes of

making taxable supplies, he will be able to claim an input

tax deduction on the acquisition of the printer amounting

to R847,37 (R6 900 × 14/114). No input tax will be

claimable on the acquisition of the motor car and coffee

machine, as input tax deductions are specifically denied

on the acquisition thereof.

Speedy will be required to levy output tax on the sale of

only the printer, since the said supply will be made in the

course or the furtherance of his enterprise. Speedy will not

be required to account for any output tax on the sale of the

coffee machine and motor car, since Speedy was denied

input tax deductions on the acquisition of these items.