Page 36 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 36

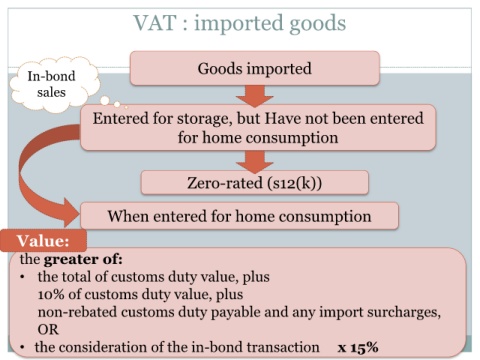

VAT : imported goods

Goods imported

In-bond

sales

Entered for storage, but Have not been entered

for home consumption

Zero-rated (s12(k))

When entered for home consumption

Value:

the greater of:

• the total of customs duty value, plus

10% of customs duty value, plus

non-rebated customs duty payable and any import surcharges,

OR

• the consideration of the in-bond transaction x 15%