Page 39 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 39

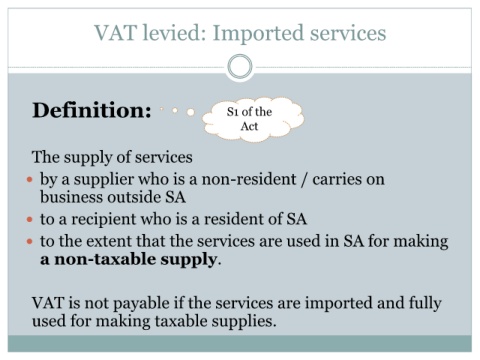

VAT levied: Imported services

Definition: S1 of the

Act

The supply of services

by a supplier who is a non-resident / carries on

business outside SA

to a recipient who is a resident of SA

to the extent that the services are used in SA for making

a non-taxable supply.

VAT is not payable if the services are imported and fully

used for making taxable supplies.