Page 36 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 36

LOS 7.e: Calculate and interpret the bank discount Session Unit 2: Discounted Cash Flow Applications

yield, holding period yield, effective annual yield, and

money market yield for US Treasury bills and other

money market instruments, p115

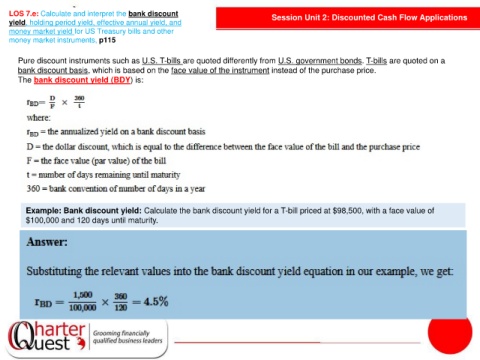

Pure discount instruments such as U.S. T-bills are quoted differently from U.S. government bonds. T-bills are quoted on a

bank discount basis, which is based on the face value of the instrument instead of the purchase price.

The bank discount yield (BDY) is:

Example: Bank discount yield: Calculate the bank discount yield for a T-bill priced at $98,500, with a face value of

$100,000 and 120 days until maturity.