Page 35 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 35

LOS 7.d: Calculate and compare the money-weighted Session Unit 2: Discounted Cash Flow Applications

and time-weighted rates of return of a portfolio and

evaluate the performance of portfolios based on these

measures.

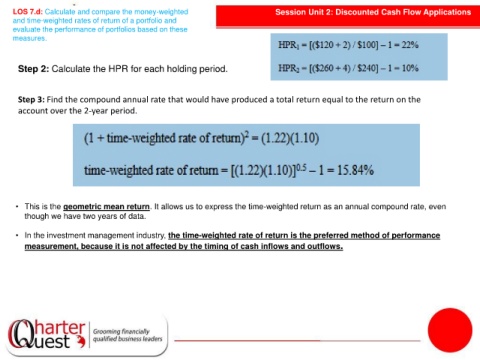

Step 2: Calculate the HPR for each holding period.

Step 3: Find the compound annual rate that would have produced a total return equal to the return on the

account over the 2-year period.

• This is the geometric mean return. It allows us to express the time-weighted return as an annual compound rate, even

though we have two years of data.

• In the investment management industry, the time-weighted rate of return is the preferred method of performance

measurement, because it is not affected by the timing of cash inflows and outflows.