Page 30 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 30

LOS 7.b: Contrast the NPV rule to the IRR rule, and Session Unit 2: Discounted Cash Flow Applications

identify problems associated with the IRR rule..

NPV + = Accept project, it will increase shareholder wealth.

NPV - = Reject project, it will decrease shareholder wealth.

• When two projects are mutually exclusive (only one can be accepted), the project with the higher positive NPV should

be accepted.

IRR decision rule:

IRR > firm’s (investor’s) required rate of return = Accept! IRR < firm’s (investor’s) required rate of return = Reject!

Problems Associated With the IRR Method

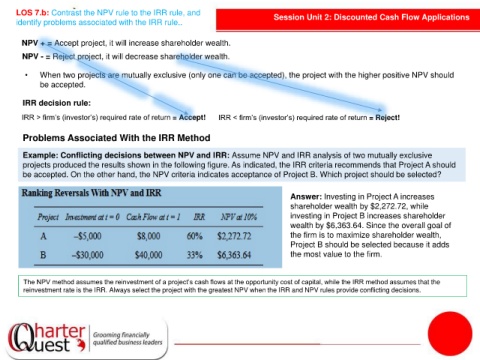

Example: Conflicting decisions between NPV and IRR: Assume NPV and IRR analysis of two mutually exclusive

projects produced the results shown in the following figure. As indicated, the IRR criteria recommends that Project A should

be accepted. On the other hand, the NPV criteria indicates acceptance of Project B. Which project should be selected?

Answer: Investing in Project A increases

shareholder wealth by $2,272.72, while

investing in Project B increases shareholder

wealth by $6,363.64. Since the overall goal of

the firm is to maximize shareholder wealth,

Project B should be selected because it adds

the most value to the firm.

The NPV method assumes the reinvestment of a project’s cash flows at the opportunity cost of capital, while the IRR method assumes that the

reinvestment rate is the IRR. Always select the project with the greatest NPV when the IRR and NPV rules provide conflicting decisions.