Page 26 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 26

LOS 6.f: Demonstrate the use of a time line in Session Unit 2: The Time Value of Money

modelling and solving time value of money

problems.

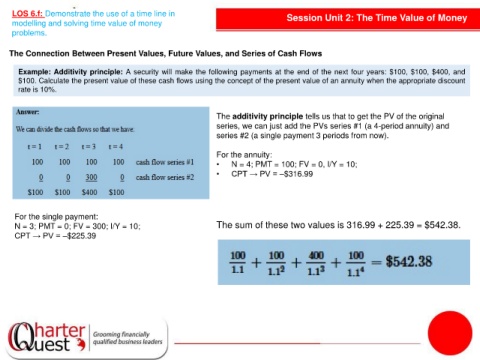

The Connection Between Present Values, Future Values, and Series of Cash Flows

Example: Additivity principle: A security will make the following payments at the end of the next four years: $100, $100, $400, and

$100. Calculate the present value of these cash flows using the concept of the present value of an annuity when the appropriate discount

rate is 10%.

The additivity principle tells us that to get the PV of the original

series, we can just add the PVs series #1 (a 4-period annuity) and

series #2 (a single payment 3 periods from now).

For the annuity:

• N = 4; PMT = 100; FV = 0, I/Y = 10;

• CPT → PV = –$316.99

For the single payment:

N = 3; PMT = 0; FV = 300; I/Y = 10; The sum of these two values is 316.99 + 225.39 = $542.38.

CPT → PV = –$225.39