Page 24 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 24

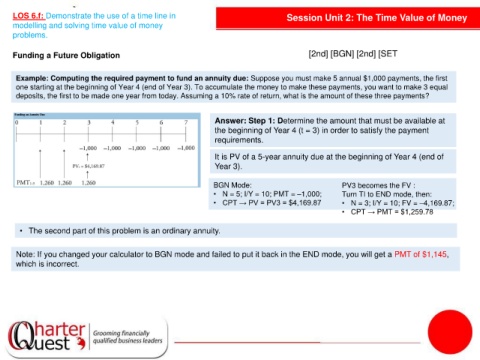

LOS 6.f: Demonstrate the use of a time line in Session Unit 2: The Time Value of Money

modelling and solving time value of money

problems.

Funding a Future Obligation [2nd] [BGN] [2nd] [SET

Example: Computing the required payment to fund an annuity due: Suppose you must make 5 annual $1,000 payments, the first

one starting at the beginning of Year 4 (end of Year 3). To accumulate the money to make these payments, you want to make 3 equal

deposits, the first to be made one year from today. Assuming a 10% rate of return, what is the amount of these three payments?

Answer: Step 1: Determine the amount that must be available at

the beginning of Year 4 (t = 3) in order to satisfy the payment

requirements.

It is PV of a 5-year annuity due at the beginning of Year 4 (end of

Year 3).

BGN Mode: PV3 becomes the FV :

• N = 5; I/Y = 10; PMT = –1,000; Turn TI to END mode, then:

• CPT → PV = PV3 = $4,169.87 • N = 3; I/Y = 10; FV = –4,169.87;

• CPT → PMT = $1,259.78

• The second part of this problem is an ordinary annuity.

Note: If you changed your calculator to BGN mode and failed to put it back in the END mode, you will get a PMT of $1,145,

which is incorrect.