Page 22 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 22

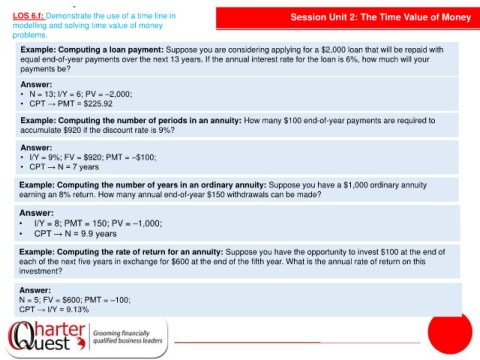

LOS 6.f: Demonstrate the use of a time line in Session Unit 2: The Time Value of Money

modelling and solving time value of money

problems.

Example: Computing a loan payment: Suppose you are considering applying for a $2,000 loan that will be repaid with

equal end-of-year payments over the next 13 years. If the annual interest rate for the loan is 6%, how much will your

payments be?

Answer:

• N = 13; I/Y = 6; PV = –2,000;

• CPT → PMT = $225.92

Example: Computing the number of periods in an annuity: How many $100 end-of-year payments are required to

accumulate $920 if the discount rate is 9%?

Answer:

• I/Y = 9%; FV = $920; PMT = –$100;

• CPT → N = 7 years

Example: Computing the number of years in an ordinary annuity: Suppose you have a $1,000 ordinary annuity

earning an 8% return. How many annual end-of-year $150 withdrawals can be made?

Answer:

• I/Y = 8; PMT = 150; PV = –1,000;

• CPT → N = 9.9 years

Example: Computing the rate of return for an annuity: Suppose you have the opportunity to invest $100 at the end of

each of the next five years in exchange for $600 at the end of the fifth year. What is the annual rate of return on this

investment?

Answer:

N = 5; FV = $600; PMT = –100;

CPT → I/Y = 9.13%