Page 23 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 23

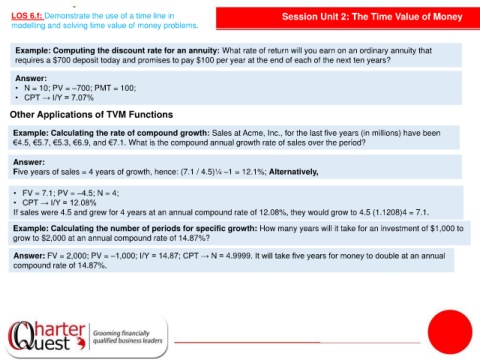

LOS 6.f: Demonstrate the use of a time line in Session Unit 2: The Time Value of Money

modelling and solving time value of money problems.

Example: Computing the discount rate for an annuity: What rate of return will you earn on an ordinary annuity that

requires a $700 deposit today and promises to pay $100 per year at the end of each of the next ten years?

Answer:

• N = 10; PV = –700; PMT = 100;

• CPT → I/Y = 7.07%

Other Applications of TVM Functions

Example: Calculating the rate of compound growth: Sales at Acme, Inc., for the last five years (in millions) have been

€4.5, €5.7, €5.3, €6.9, and €7.1. What is the compound annual growth rate of sales over the period?

Answer:

Five years of sales = 4 years of growth, hence: (7.1 / 4.5)¼ –1 = 12.1%; Alternatively,

• FV = 7.1; PV = –4.5; N = 4;

• CPT → I/Y = 12.08%

If sales were 4.5 and grew for 4 years at an annual compound rate of 12.08%, they would grow to 4.5 (1.1208)4 = 7.1.

Example: Calculating the number of periods for specific growth: How many years will it take for an investment of $1,000 to

grow to $2,000 at an annual compound rate of 14.87%?

Answer: FV = 2,000; PV = –1,000; I/Y = 14.87; CPT → N = 4.9999. It will take five years for money to double at an annual

compound rate of 14.87%.