Page 21 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 21

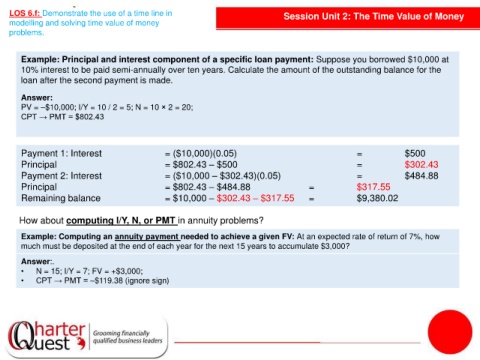

LOS 6.f: Demonstrate the use of a time line in Session Unit 2: The Time Value of Money

modelling and solving time value of money

problems.

Example: Principal and interest component of a specific loan payment: Suppose you borrowed $10,000 at

10% interest to be paid semi-annually over ten years. Calculate the amount of the outstanding balance for the

loan after the second payment is made.

Answer:

PV = –$10,000; I/Y = 10 / 2 = 5; N = 10 × 2 = 20;

CPT → PMT = $802.43

Payment 1: Interest = ($10,000)(0.05) = $500

Principal = $802.43 – $500 = $302.43

Payment 2: Interest = ($10,000 – $302.43)(0.05) = $484.88

Principal = $802.43 – $484.88 = $317.55

Remaining balance = $10,000 – $302.43 – $317.55 = $9,380.02

How about computing I/Y, N, or PMT in annuity problems?

Example: Computing an annuity payment needed to achieve a given FV: At an expected rate of return of 7%, how

much must be deposited at the end of each year for the next 15 years to accumulate $3,000?

Answer:.

• N = 15; I/Y = 7; FV = +$3,000;

• CPT → PMT = –$119.38 (ignore sign)