Page 16 - F6 - Capital Allowances - Intellectual Property & Recoupments

P. 16

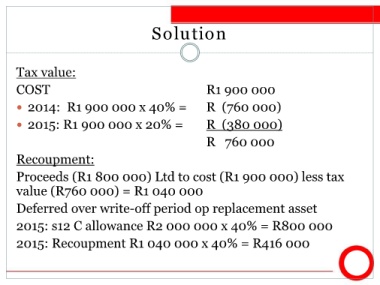

Solution

Tax value:

COST R1 900 000

2014: R1 900 000 x 40% = R (760 000)

2015: R1 900 000 x 20% = R (380 000)

R 760 000

Recoupment:

Proceeds (R1 800 000) Ltd to cost (R1 900 000) less tax

value (R760 000) = R1 040 000

Deferred over write-off period op replacement asset

2015: s12 C allowance R2 000 000 x 40% = R800 000

2015: Recoupment R1 040 000 x 40% = R416 000