Page 17 - F6 - Capital Allowances - Intellectual Property & Recoupments

P. 17

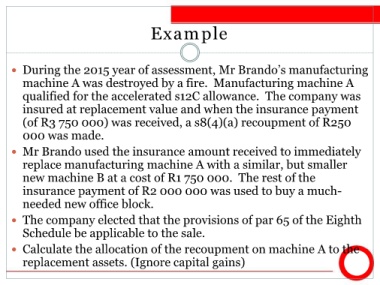

Example

During the 2015 year of assessment, Mr Brando’s manufacturing

machine A was destroyed by a fire. Manufacturing machine A

qualified for the accelerated s12C allowance. The company was

insured at replacement value and when the insurance payment

(of R3 750 000) was received, a s8(4)(a) recoupment of R250

000 was made.

Mr Brando used the insurance amount received to immediately

replace manufacturing machine A with a similar, but smaller

new machine B at a cost of R1 750 000. The rest of the

insurance payment of R2 000 000 was used to buy a much-

needed new office block.

The company elected that the provisions of par 65 of the Eighth

Schedule be applicable to the sale.

Calculate the allocation of the recoupment on machine A to the

replacement assets. (Ignore capital gains)