Page 7 - F6 - Capital Allowances - Intellectual Property & Recoupments

P. 7

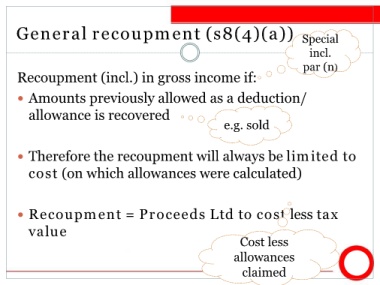

General recoupment (s8(4)(a)) Special

incl.

par (n)

Recoupment (incl.) in gross income if:

Amounts previously allowed as a deduction/

allowance is recovered

e.g. sold

Therefore the recoupment will always be limited to

cost (on which allowances were calculated)

Recoupment = Proceeds Ltd to cost less tax

value

Cost less

allowances

claimed