Page 8 - F6 - Capital Allowances - Intellectual Property & Recoupments

P. 8

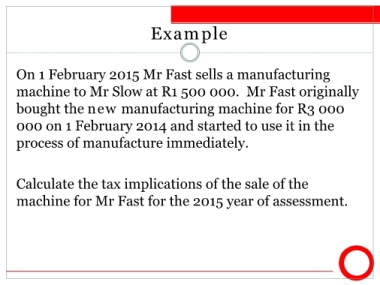

Example

On 1 February 2015 Mr Fast sells a manufacturing

machine to Mr Slow at R1 500 000. Mr Fast originally

bought the new manufacturing machine for R3 000

000 on 1 February 2014 and started to use it in the

process of manufacture immediately.

Calculate the tax implications of the sale of the

machine for Mr Fast for the 2015 year of assessment.