Page 13 - F6 - Special Deductions

P. 13

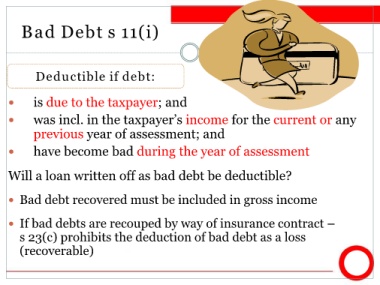

Bad Debt s 11(i)

Deductible if debt:

is due to the taxpayer; and

was incl. in the taxpayer’s income for the current or any

previous year of assessment; and

have become bad during the year of assessment

Will a loan written off as bad debt be deductible?

Bad debt recovered must be included in gross income

If bad debts are recouped by way of insurance contract –

s 23(c) prohibits the deduction of bad debt as a loss

(recoverable)