Page 17 - F6 - Special Deductions

P. 17

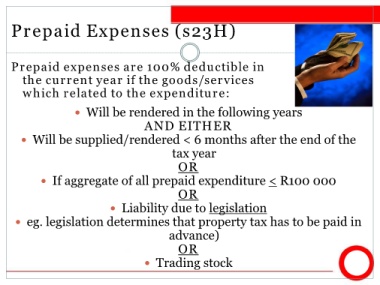

Prepaid Expenses (s23H)

Prepaid expenses are 100% deductible in

the current year if the goods/services

which related to the expenditure:

Will be rendered in the following years

AND EITHER

Will be supplied/rendered < 6 months after the end of the

tax year

OR

If aggregate of all prepaid expenditure < R100 000

OR

Liability due to legislation

eg. legislation determines that property tax has to be paid in

advance)

OR

Trading stock