Page 12 - TAX4862/2 APPLIED TAXATION

P. 12

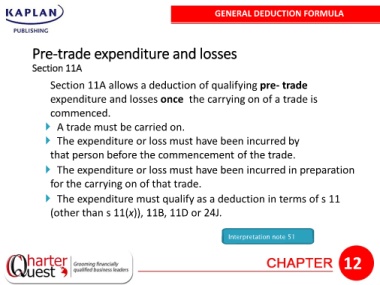

GENERAL DEDUCTION FORMULA

Pre-trade expenditure and losses

Section 11A

Section 11A allows a deduction of qualifying pre- trade

expenditure and losses once the carrying on of a trade is

commenced.

A trade must be carried on.

The expenditure or loss must have been incurred by

that person before the commencement of the trade.

The expenditure or loss must have been incurred in preparation

for the carrying on of that trade.

The expenditure must qualify as a deduction in terms of s 11

(other than s 11(x)), 11B, 11D or 24J.

Interpretation note 51

12