Page 18 - TAX4862/2 APPLIED TAXATION

P. 18

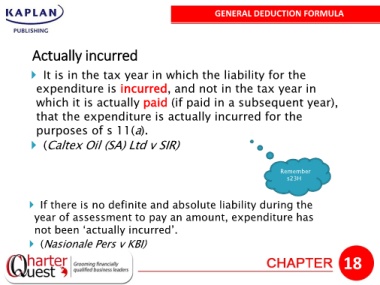

GENERAL DEDUCTION FORMULA

Actually incurred

It is in the tax year in which the liability for the

expenditure is incurred, and not in the tax year in

which it is actually paid (if paid in a subsequent year),

that the expenditure is actually incurred for the

purposes of s 11(a).

(Caltex Oil (SA) Ltd v SIR)

Remember

s23H

If there is no definite and absolute liability during the

year of assessment to pay an amount, expenditure has

not been ‘actually incurred’.

(Nasionale Pers v KBI)

18