Page 8 - FINAL CFA I SLIDES JUNE 2019 DAY 4

P. 8

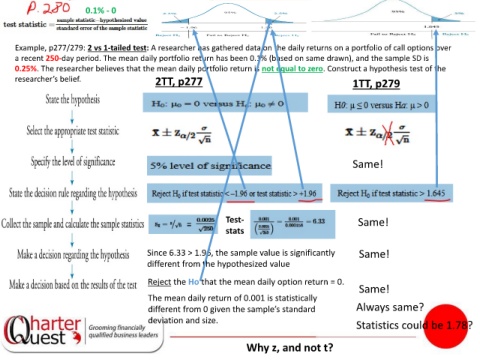

0.1% - 0

Example, p277/279: 2 vs 1-tailed test: A researcher has gathered data on the daily returns on a portfolio of call options over

a recent 250-day period. The mean daily portfolio return has been 0.1% (based on same drawn), and the sample SD is

0.25%. The researcher believes that the mean daily portfolio return is not equal to zero. Construct a hypothesis test of the

researcher’s belief. 2TT, p277 1TT, p279

Same!

Test- Same!

stats

Since 6.33 > 1.96, the sample value is significantly Same!

different from the hypothesized value

Reject the Ho that the mean daily option return = 0.

Same!

The mean daily return of 0.001 is statistically

different from 0 given the sample’s standard Always same?

deviation and size.

Statistics could be 1.78?

Why z, and not t?