Page 60 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 60

Session Unit 3:

LOS 10.m: Define shortfall risk, calculate

the safety-first ratio, and select an optimal 10. Common Probability Distributions

portfolio using Roy’s safety-first criterion,

p.229

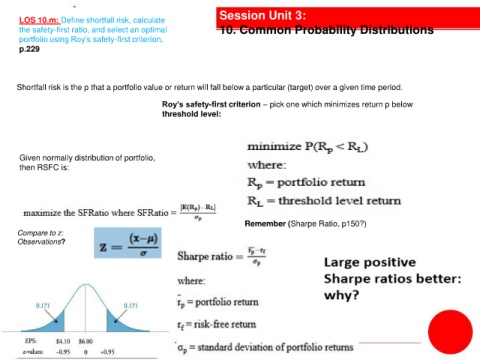

Shortfall risk is the p that a portfolio value or return will fall below a particular (target) over a given time period.

Roy’s safety-first criterion – pick one which minimizes return p below

threshold level:

Given normally distribution of portfolio,

then RSFC is:

Remember (Sharpe Ratio, p150?)

Compare to z:

Observations?